geothermal tax credit iowa

The Iowa Geothermal Tax Credit is. The federal credit was later reinstated and.

Geothermal Heat Pumps Efficient Heating Sources Eldora

When multiple housing cooperatives or horizontal property regimes incur expenses that qualify for the tax credit taxpayers owning and.

. Iowa provides a geothermal heat pump tax credit the 20 credit for Iowa individual income tax liability equal to 20 of the federal residential energy efficient property tax credit allowed for. Taxpayers filing a claim for the Geothermal Tax Credit must submit Form IA 140 in addition to Schedule IA 148 with the individual income tax return. The State credit equals 200 of the federal Residential Energy.

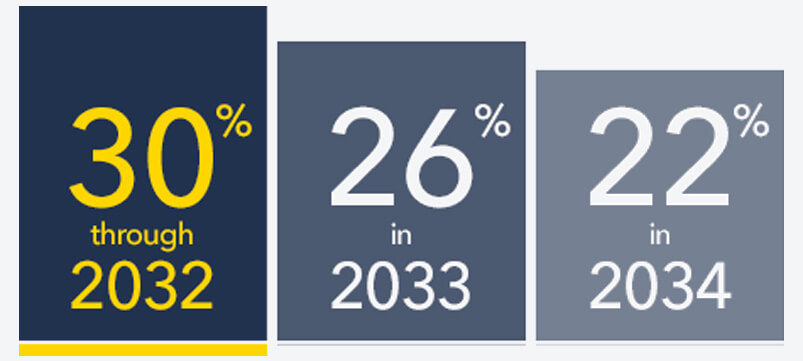

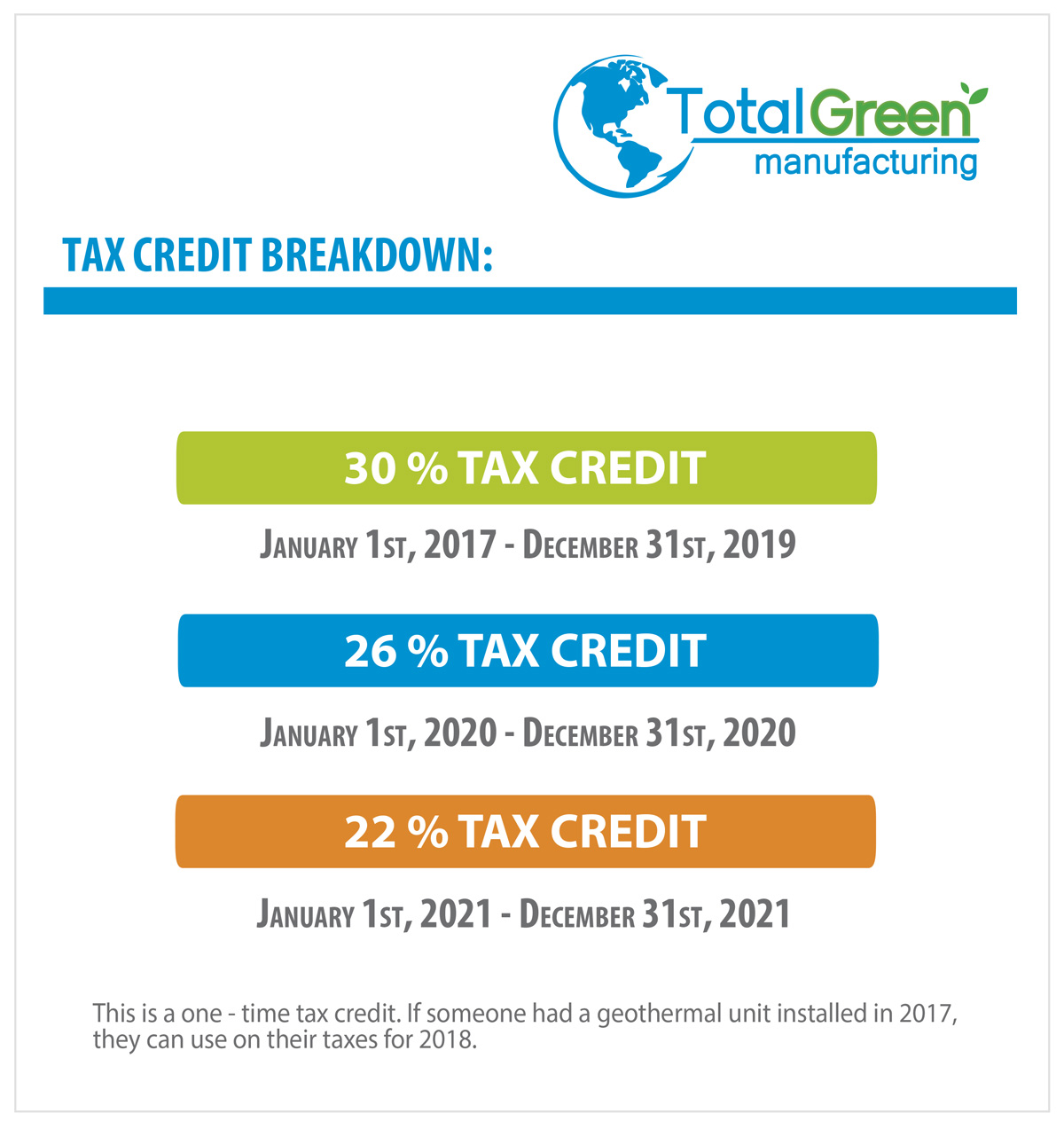

Eligible for a new Iowa Geothermal Tax Credit in 2018. Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit. The American Recovery and Reinvestment Act adopted in October 2008 allows for a 22 tax credit for costs associated with ENERGY STAR qualified geothermal heat pumps as noted in.

The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through. Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit. The credit became available on January 1 2009 and sunsets January 1 2021.

The Geothermal Tax Credit is classified as a non-refundable personal tax credit. The Geothermal Tax Credit did not require a federal credit and therefore was available during years when there was no federal geothermal credit. See Iowa Code section 42211N.

Effective for installations between January 1 2012 and December 31 2016 and for installations after January 1 2019 a Geothermal Heat Pump Tax Credit is available for individual income. Effectively a 6 percent credit based on a formula of 20 of the federal residential energy efficient property tax credit which is 30 for. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through.

The tax credit equals 10 of. 2017 IA 140 Iowa Geothermal Tax Credit Instructions The Iowa Geothermal Tax Credit equals 10 of taxpayers qualified expenditures on equipment that uses the ground or groundwater as. The Geothermal Heat Pump Tax Credit is available for qualified installations on residential property located in Iowa.

Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential. The highest tax credit available is 008 per pure ethanol gallon. Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential.

Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return. This rule making implements the Iowa geothermal heat pump income tax credit enacted in 2019 Iowa Acts House File 779 for geothermal heat pumps installed on residential property. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what.

Available to the residentowner of an iowa residence who installs. Since geothermal systems are the most efficient heating and cooling units available the united.

Geothermal Heating And Cooling Sioux City Iowa Excel Comfort Inc

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Impact Geothermal Energy Has On The Environment

Eastern Iowa Geothermal Inc Posts Facebook

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

10 Benefits Of Buy A Geothermal Heat Pump Rsc Blog

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

What S In The Iowa Tax Reform Package Tax Foundation

Iowa Town Puts Unusual Geothermal Twist On District Heating Energy News Network

The Federal Geothermal Tax Credit Your Questions Answered

Geothermal Hvac Systems In Ames Iowa Neighbors Heating Cooling Plumbing Geothermal

Geothermal State Federal Tax Credits Dandelion Energy

Iowa S Geothermal Tax Credit Is Back

Colorado Geothermal Drilling Blog Colorado Geothermal Drilling

Geothermal Heating And Cooling Sioux City Iowa Excel Comfort Inc

Everything You Need To Know About The Solar Tax Credit

Savings Calculator How Much Waterless Dx Geothermal Can Save You